Digital Loan Origination

Flexible Loan Servicing Options

Automated Underwriting

One-roof Loan management

White-label Loan

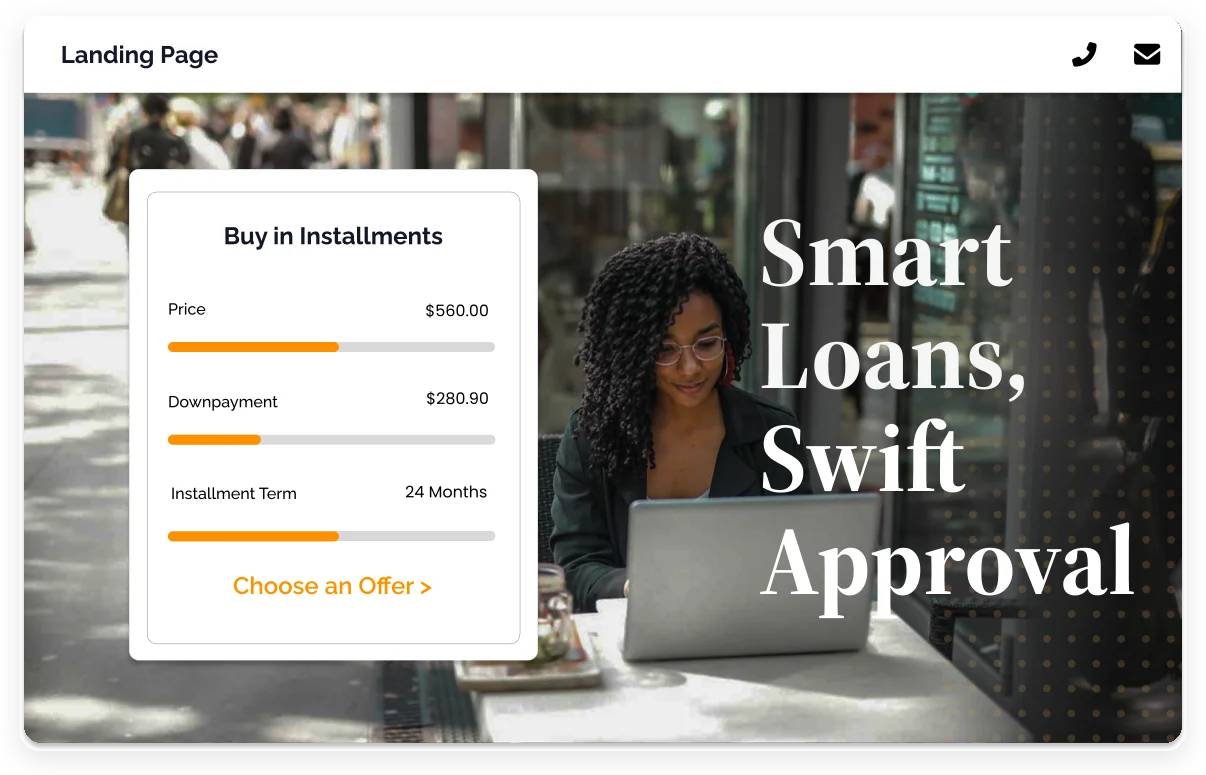

Application

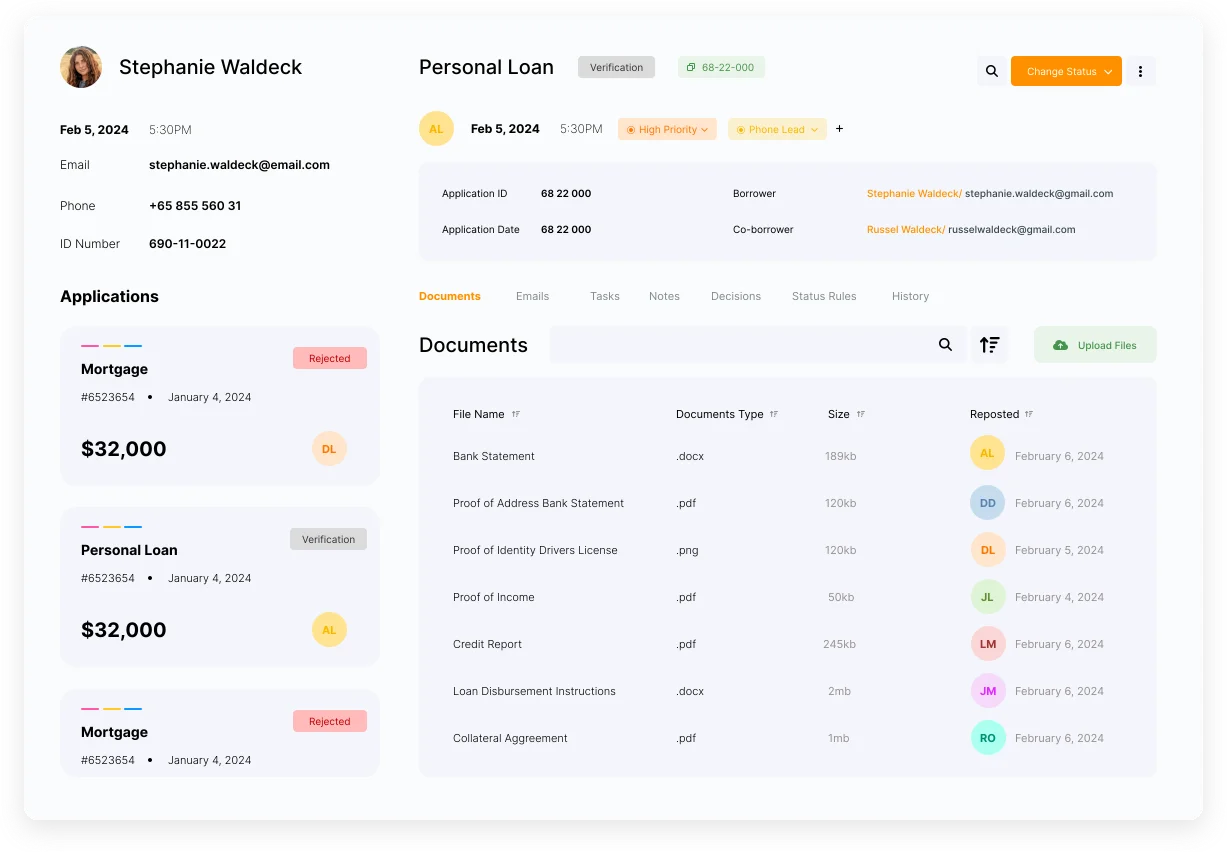

Provide your borrowers with the option to conveniently apply for loans online.

Integrate a loan calculator on your website to showcase loan offerings and attract clients. Use a responsive landing page for clients to calculate loan terms easily on any device, ensuring a seamless experience.

Your Branded Mobile app

Agents can efficiently invite colleagues using their email addresses to streamline the onboarding process. They also have immediate access to the contact details of potential leads, enabling them to extend precise and tailored offers.

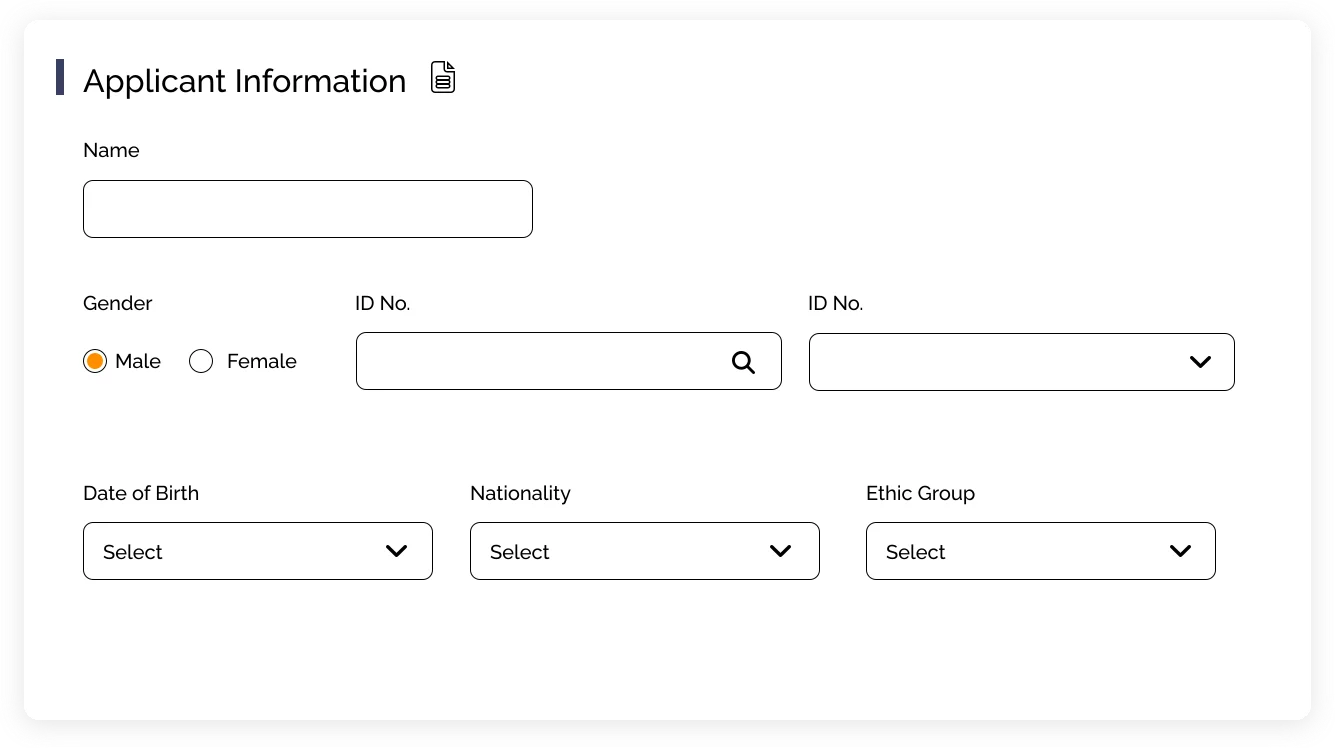

Know Your Customer

Our system uses a KYC plugin and biometric authentication to identify borrowers in just 30 seconds, ensuring top-notch security while expediting underwriting for your business.

Saas Loan

Origination Software

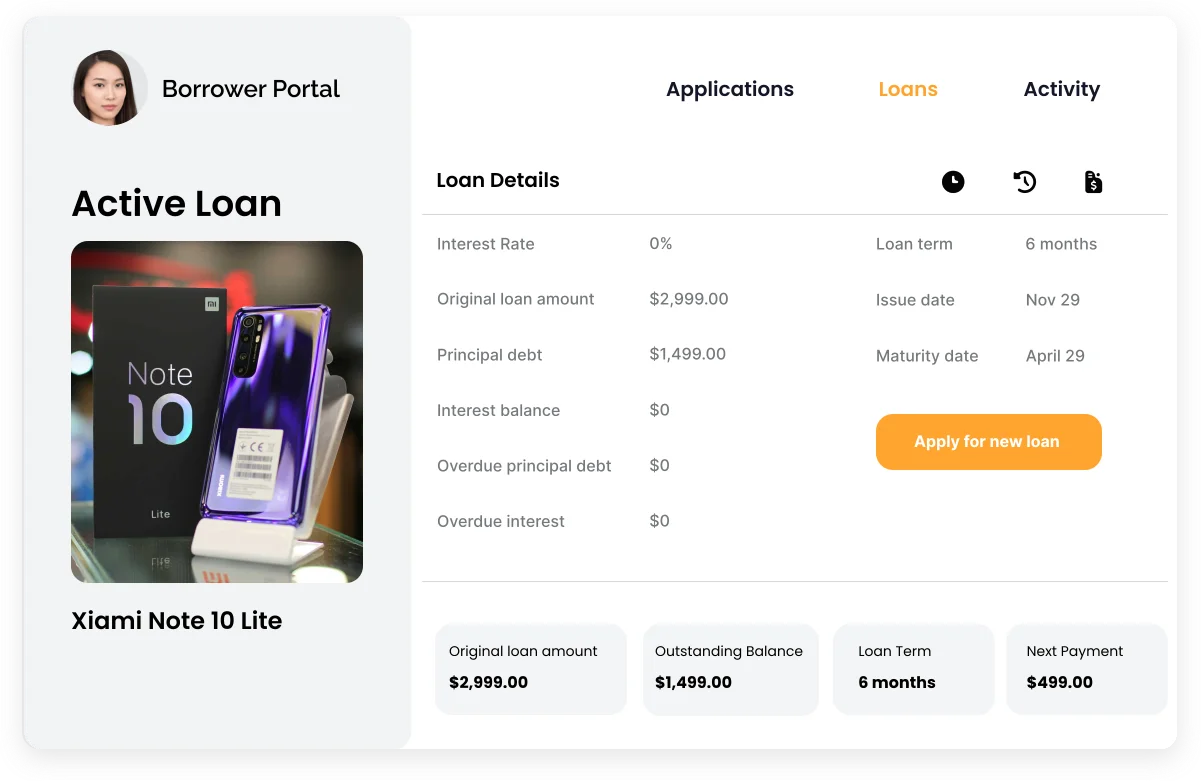

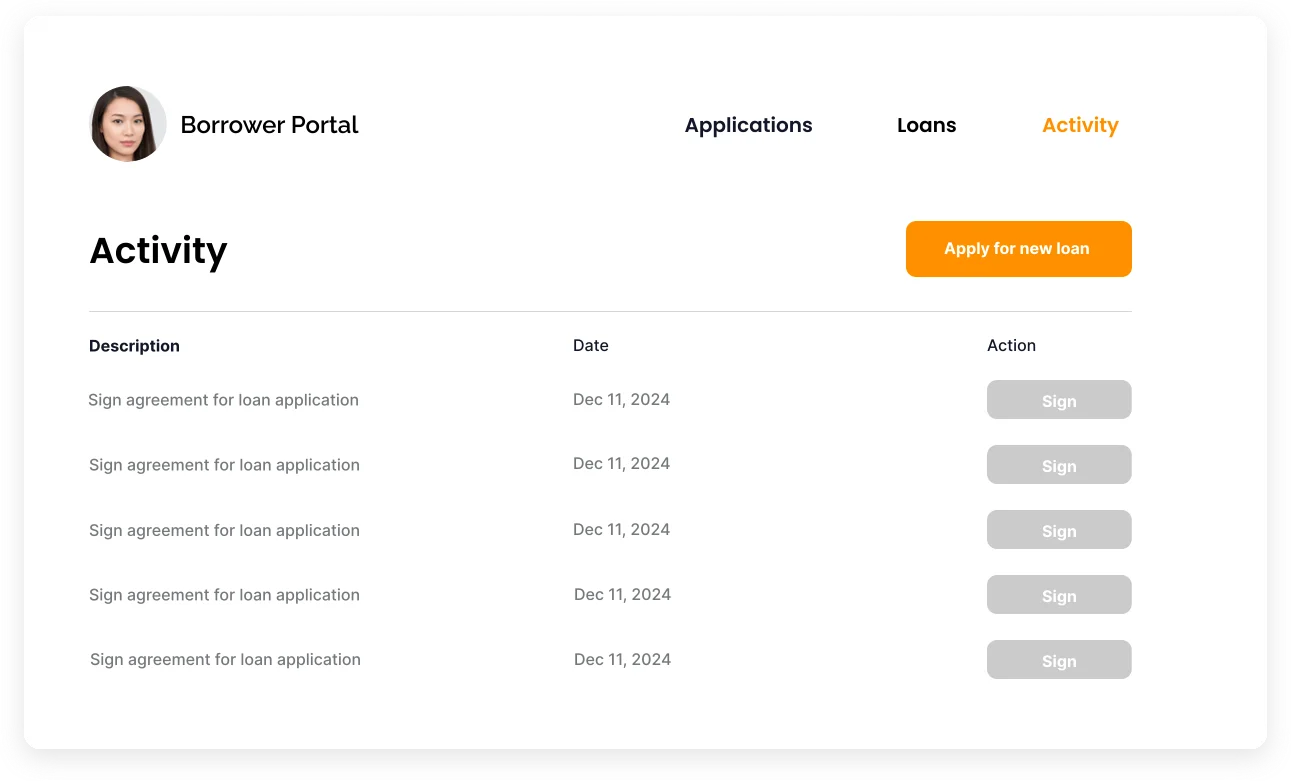

Enable borrowers to access a personalized web portal.

Clients can easily apply for loans, track the approval process, and securely upload documents from their personal space. Efficient SaaS loan origination software saves time for credit officers and improves customer satisfaction.

Application Flow

Clients have instant access to their entire application history and real-time application statuses, ensuring borrowers stay informed about approval or rejection.

SMS and Email Notifications

Our SaaS lending platform sends automatic notifications through the client’s preferred channel, improving efficiency. Keep borrowers informed with updates and reminders sent via SMS and email.

Payment Schedules

To prevent delinquency, keep borrowers informed by accessing payment schedules for active loans, including due dates, interest rates, and the final repayment term.

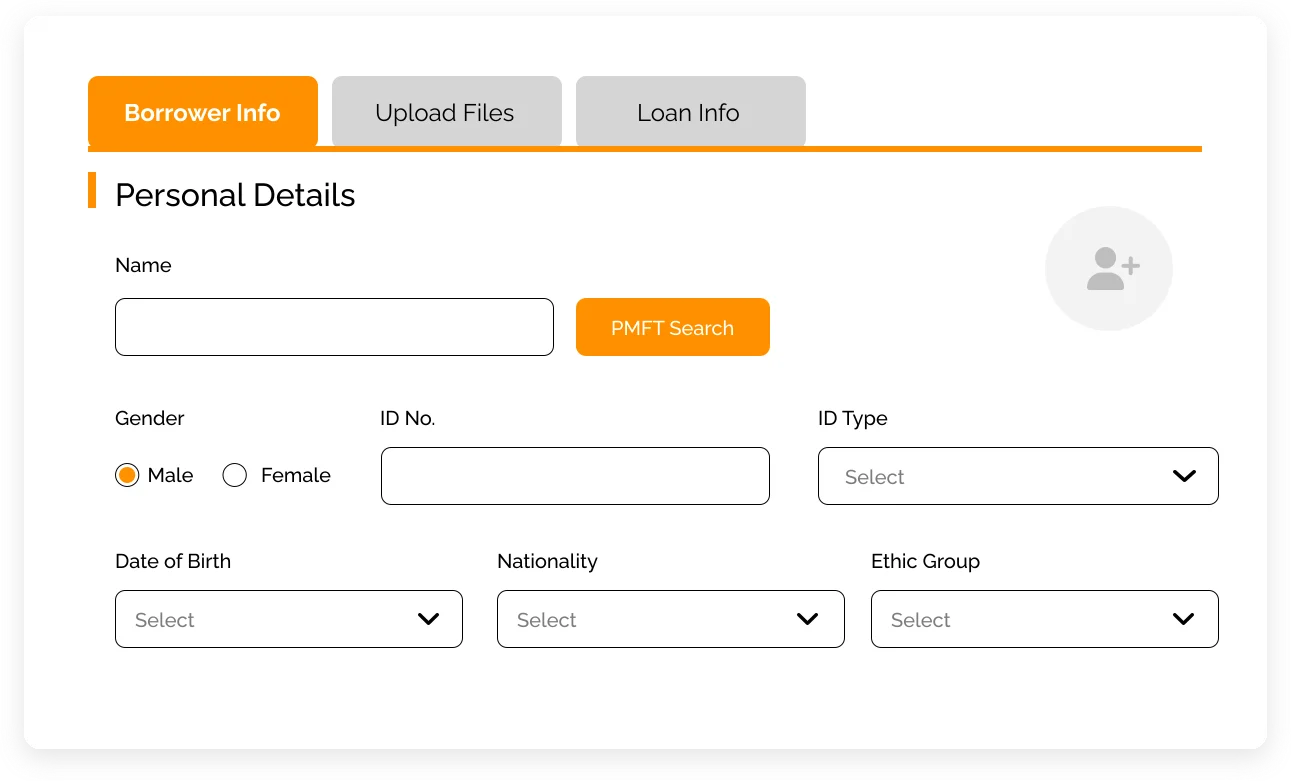

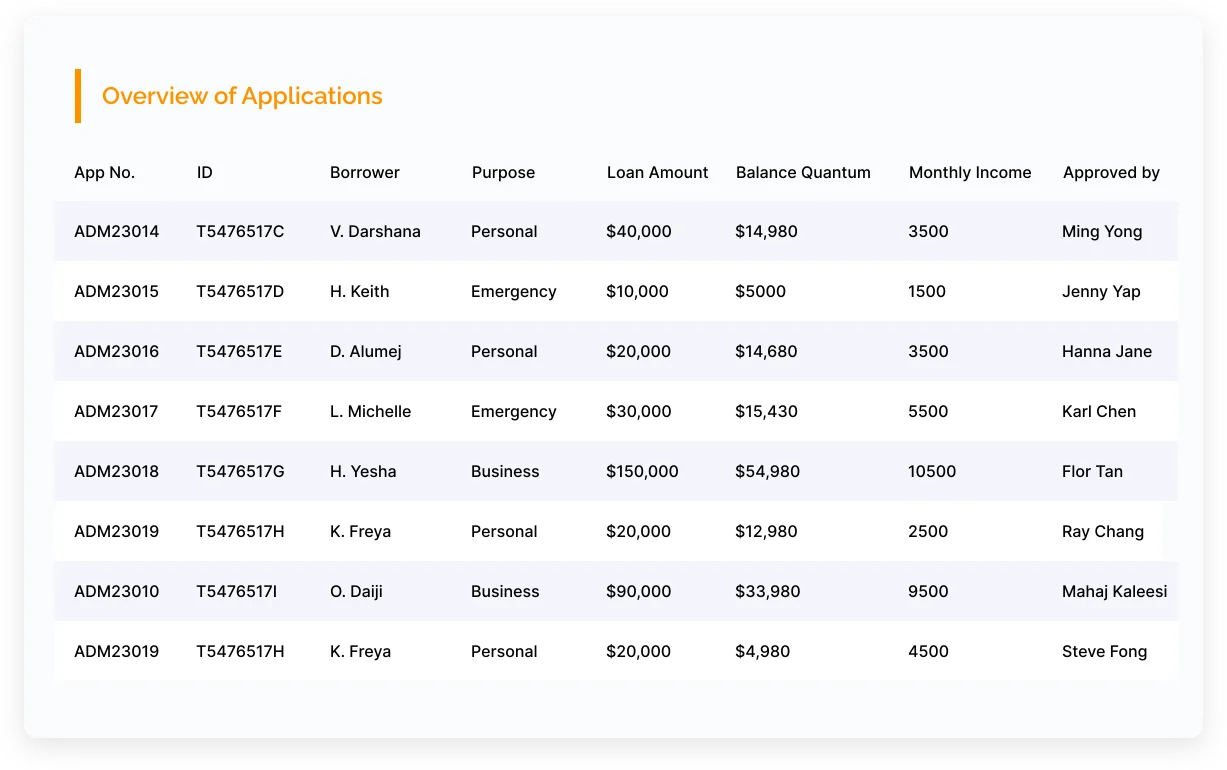

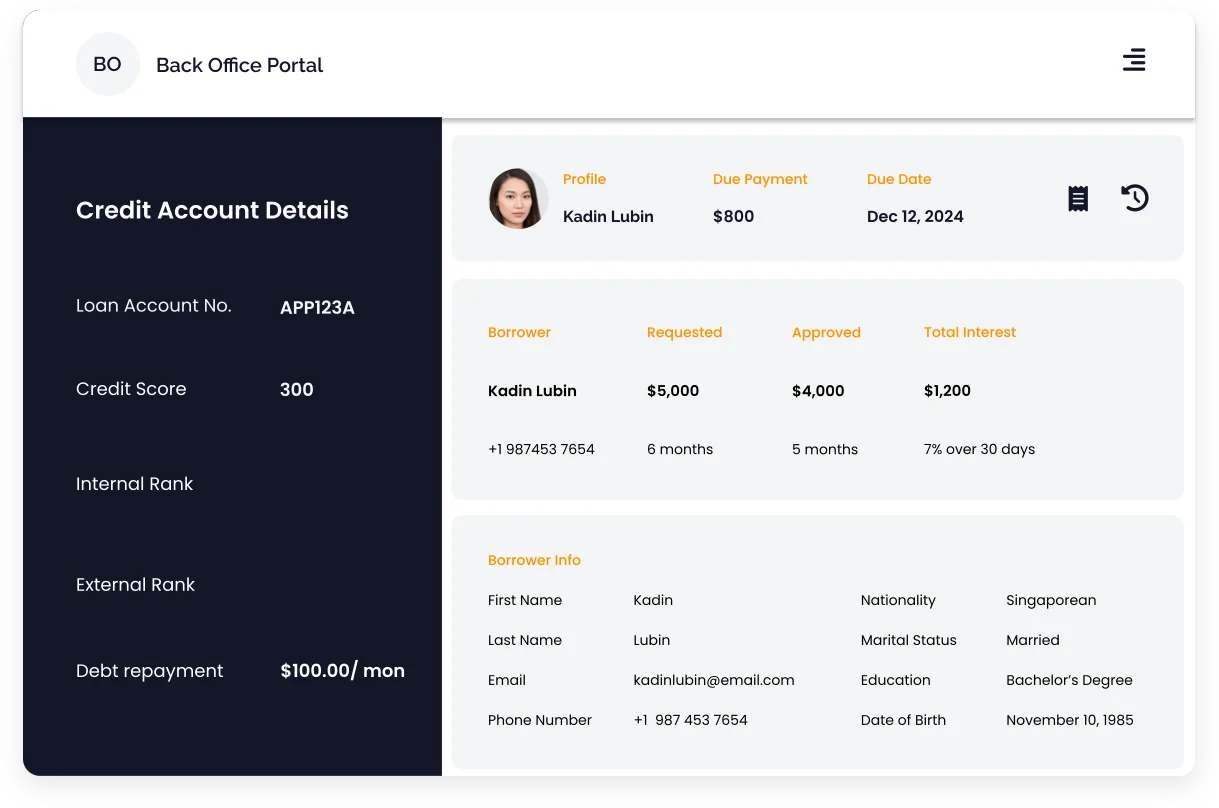

Back Office

Boost managers’ efficiency with a versatile back-office solution.

Your team can effectively manage applications, loans, borrowers, credit products, and collections to increase efficiency and flexibility in banking and financial services.

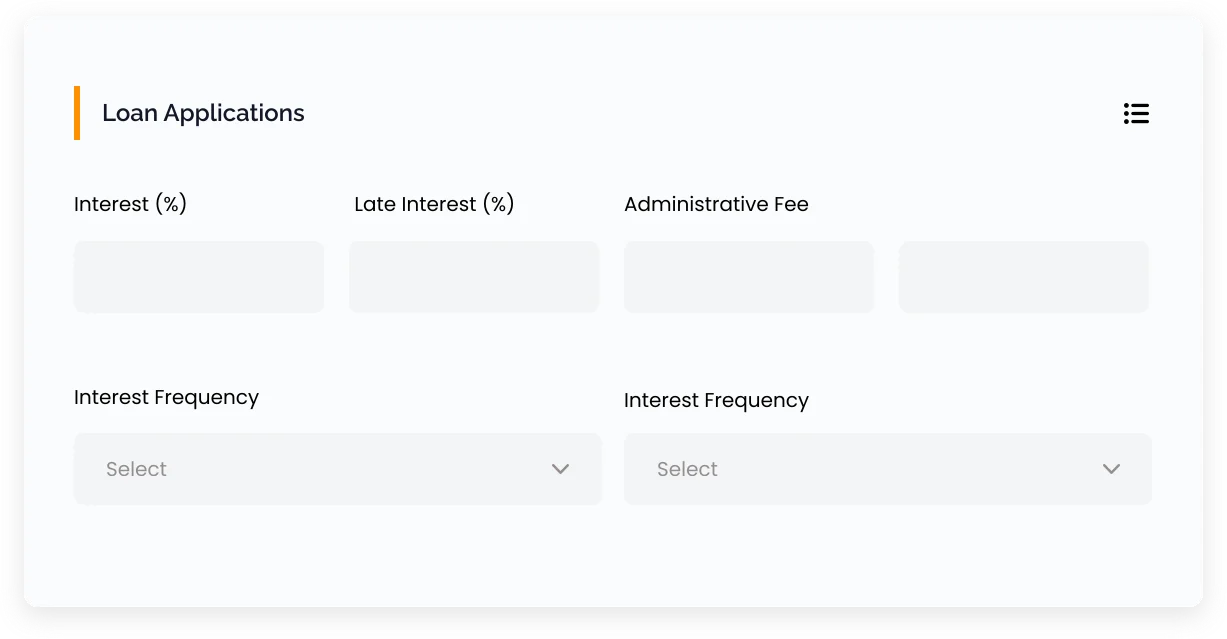

Calculations

Improve lending analysis by diversifying credit options, offering customized loan packages, and embracing innovative calculation methods as your business expands.

Configurable loans

Create new loan options quickly: adjust terms, set limits, and fine-tune interest rates with ease. Streamlined customization for a better customer journey.

Key Features

Know Your Customer

Streamline ID verification and KYC with integrated in-house and third-party solutions, ensuring precise compliance.

Roles & Permissions

Protect your data and reduce risks. Efficiently manage user roles with access to essential modules only.

Reports & Dashboards

Our system starts a data journey with advanced KPI dashboards, metric reports, and Business Intelligence integration to enhance decision-making.

Power Integrations

Integrate tailored fintech solutions like credit bureaus, payment wizards, and e-signatures—into Sivren's lending platform using APIs.

Notifications

Set up notifications to keep clients informed. Ensure the borrower team receives regular updates via SMS, email, automatic payment reminders, and action items for better communication.

Risk Management

Anticipate defaults, manage credit risks, evaluate portfolios for insights, set optimal thresholds to identify high-risk assets, and forecast non-performing loans accurately.

Robust Back Office

Functionality for Supervisors

Sivren specializes in creating custom software solutions for moneylenders, designed to enhance operational efficiency and meet their specific needs. We pride ourselves on our commitment to quality, customer satisfaction, and building lasting partnerships within the financial technology sector.

Terms of Use

© 2024. Sivren Pte Ltd (UEN: 201006285G). All rights reserved

Feel free to email us at [email protected] or reach out via WhatsApp at +65 8010 5519.